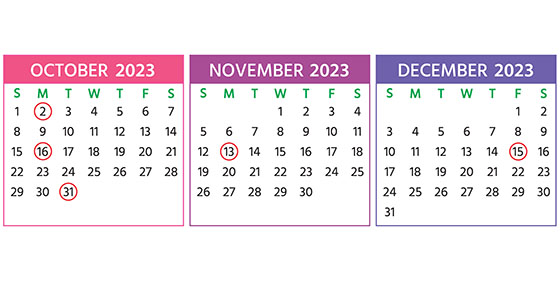

2023 Q4 tax calendar: Key deadlines for businesses and other employers

November 6, 2023

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: […]

Continue readingIt’s important to understand how taxes factor into M&A transactions

October 30, 2023

In recent years, merger and acquisition activity has been strong in many industries. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law. Stocks vs. assets From a tax standpoint, a transaction can basically be structured in two ways: 1. Stock […]

Continue readingSpouse-run businesses face special tax issues

October 23, 2023

Do you and your spouse together operate a profitable unincorporated small business? If so, you face some challenging tax issues. The partnership issue An unincorporated business with your spouse is classified as a partnership for federal income tax purposes, unless you can avoid that treatment. Otherwise, you must file an annual partnership return, on Form […]

Continue readingUpdate on depreciating business assets

October 16, 2023

The Tax Cuts and Jobs Act liberalized the rules for depreciating business assets. However, the amounts change every year due to inflation adjustments. And due to high inflation, the adjustments for 2023 were big. Here are the numbers that small business owners need to know. Section 179 deductions For qualifying assets placed in service in […]

Continue readingDivorcing business owners should pay attention to the tax consequences

October 9, 2023

If you’re getting a divorce, you know the process is generally filled with stress. But if you’re a business owner, tax issues can complicate matters even more. Your business ownership interest is one of your biggest personal assets and in many cases, your marital property will include all or part of it. Transferring property tax-free […]

Continue readingGuaranteeing a loan to your corporation? There may be tax implications

October 2, 2023

Let’s say you decide to, or are asked to, guarantee a loan to your corporation. Before agreeing to act as a guarantor, endorser or indemnitor of a debt obligation of your closely held corporation, be aware of the possible tax implications. If your corporation defaults on the loan and you’re required to pay principal or […]

Continue readingIRS suspends processing of ERTC claims

September 25, 2023

In the face of a flood of illegitimate claims for the Employee Retention Tax Credit (ERTC), the IRS has imposed an immediate moratorium through at least the end of 2023 on processing new claims for the credit. The reason the IRS cites for the move is the risk of honest small business owners being scammed […]

Continue readingIRS issues guidance on new retirement catch-up contribution rules

September 20, 2023

In December 2022, President Biden signed the Setting Every Community Up for Retirement Enhancement (SECURE) 2.0 Act. Among other things, the sweeping new law made some significant changes to so-called catch-up contributions, with implications for both employers and employees. With the new catch-up provisions scheduled to kick in after 2023, many retirement plan sponsors have been struggling […]

Continue readingPlanning ahead for 2024: Should your 401(k) help employees with emergencies?

September 11, 2023

The SECURE 2.0 law, which was enacted last year, contains wide-ranging changes to retirement plans. One provision in the law is that eligible employers will soon be able to provide more help to staff members facing emergencies. This will be done through what the law calls “pension-linked emergency savings accounts.” Effective for plan years beginning […]

Continue reading