Inflation enhances the 2023 amounts for Health Savings Accounts

May 19, 2022

The IRS recently released guidance providing the 2023 inflation-adjusted amounts for Health Savings Accounts (HSAs). High inflation rates will result in next year’s amounts being increased more than they have been in recent years. HSA basics An HSA is a trust created or organized exclusively for the purpose of paying the “qualified medical expenses” of […]

Continue readingBusinesses may receive notices about information returns that don’t match IRS records

May 13, 2022

The IRS has begun mailing notices to businesses, financial institutions and other payers that filed certain returns with information that doesn’t match the agency’s records. These CP2100 and CP2100A notices are sent by the IRS twice a year to payers who filed information returns that are missing a Taxpayer Identification Number (TIN), have an incorrect […]

Continue readingAfter tax day: Take these action steps

May 9, 2022

The April tax filing deadline has passed, but that doesn’t mean you should push your taxes out of your mind until next year. Here are three tax-related actions that you should consider taking in the near term (if you filed on time and didn’t file for an extension). Retain the requisite records Depending on the […]

Continue readingThe tax mechanics involved in the sale of trade or business property

April 26, 2022

There are many rules that can potentially apply to the sale of business property. Thus, to simplify discussion, let’s assume that the property you want to sell is land or depreciable property used in your business, and has been held by you for more than a year. (There are different rules for property held primarily […]

Continue readingTax issues to assess when converting from a C corporation to an S corporation

April 22, 2022

Operating as an S corporation may help reduce federal employment taxes for small businesses in the right circumstances. Although S corporations may provide tax advantages over C corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Here’s a quick rundown of the most important issues to […]

Continue readingTax considerations when adding a new partner at your business

April 18, 2022

Adding a new partner in a partnership has several financial and legal implications. Let’s say you and your partners are planning to admit a new partner. The new partner will acquire a one-third interest in the partnership by making a cash contribution to it. Let’s further assume that your bases in your partnership interests are […]

Continue readingCongress eyes further retirement savings enhancements

April 15, 2022

In 2019, the bipartisan Setting Every Community Up for Retirement Enhancement Act (SECURE Act) — the first significant legislation related to retirement savings since 2006 — became law. Now Congress appears ready to build on that law to further increase Americans’ retirement security. The U.S. House of Representatives passed the Securing a Strong Retirement Act […]

Continue readingFully deduct business meals this year

April 11, 2022

The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants in 2022 (and 2021). So, you can […]

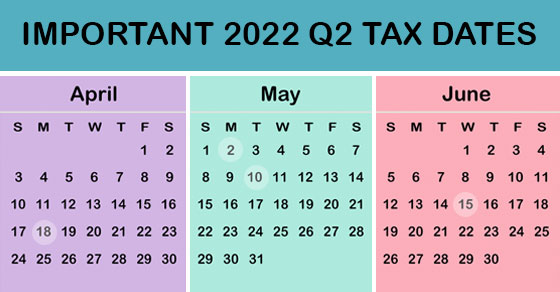

Continue reading2022 Q2 tax calendar: Key deadlines for businesses and other employers

April 1, 2022

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing […]

Continue reading