SECURE 2.0: Which provisions went into effect in 2024?

July 8, 2024

The Setting Every Community Up for Retirement Enhancement (SECURE) 2.0 Act was signed into law in December 2022, bringing more than 90 changes to retirement plan and tax laws. Many of its provisions are little known and were written to roll out over several years rather than immediately taking effect. Here are several important changes that […]

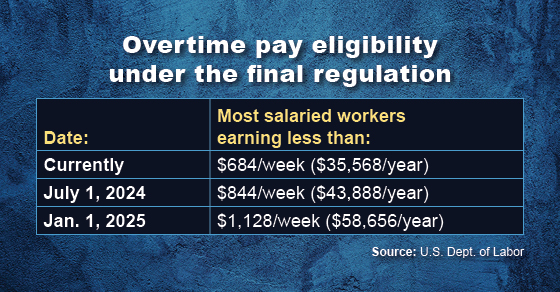

Continue readingFederal regulators expand overtime pay requirements, ban most noncompete agreements

July 1, 2024

The U.S. Department of Labor (DOL) has issued a new final rule regarding the salary threshold for determining whether employees are exempt from federal overtime pay requirements. The threshold is slated to jump 65% from its current level by 2025 and is expected to make four million additional workers eligible for overtime pay. On the same […]

Continue readingHiring your child to work at your business this summer

June 26, 2024

With school out, you might be hiring your child to work at your company. In addition to giving your son or daughter some business knowledge, you and your child could reap some tax advantages. Benefits for your child There are special tax breaks for hiring your offspring if you operate your business as one of […]

Continue readingIRS extends relief for inherited IRAs

June 24, 2024

For the third consecutive year, the IRS has published guidance that offers some relief to taxpayers covered by the “10-year rule” for required minimum distributions (RMDs) from inherited IRAs or other defined contribution plans. But the IRS also indicated in Notice 2024-35 that forthcoming final regulations for the rule will apply for the purposes of determining […]

Continue readingIRS issues guidance on tax treatment of energy efficiency rebates

June 21, 2024

The Inflation Reduction Act (IRA) established and expanded numerous incentives to encourage taxpayers to increase their use of renewable energy and adoption of a range of energy efficient improvements. In particular, the law includes funding for nearly $9 billion in home energy rebates. While the rebates aren’t yet available, many states are expected to launch their programs […]

Continue readingScrupulous records and legitimate business expenses are the key to less painful IRS audits

June 10, 2024

If you operate a business, or you’re starting a new one, you know records of income and expenses need to be kept. Specifically, you should carefully record expenses to claim all the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported on your tax returns in […]

Continue readingCoordinating Sec. 179 tax deductions with bonus depreciation

June 3, 2024

Your business should generally maximize current year depreciation write-offs for newly acquired assets. Two federal tax breaks can be a big help in achieving this goal: first-year Section 179 depreciation deductions and first-year bonus depreciation deductions. These two deductions can potentially allow businesses to write off some or all of their qualifying asset expenses in Year 1. […]

Continue readingBartering is a taxable transaction even if no cash is exchanged

May 27, 2024

If your small business is strapped for cash (or likes to save money), you may find it beneficial to barter or trade for goods and services. Bartering isn’t new — it’s the oldest form of trade — but the internet has made it easier to engage in with other businesses. However, if your business begins […]

Continue readingMaximize the QBI deduction before it’s gone

May 20, 2024

The qualified business income (QBI) deduction is available to eligible businesses through 2025. After that, it’s scheduled to disappear. So if you’re eligible, you want to make the most of the deduction while it’s still on the books because it can potentially be a big tax saver. Deduction basics The QBI deduction is written off […]

Continue reading