Cash or accrual accounting: What’s best for tax purposes?

October 28, 2024

Your businesses may have a choice between using the cash or accrual method of accounting for tax purposes. The cash method often provides significant tax benefits for those that qualify. However, some businesses may be better off using the accrual method. Therefore, you need to evaluate the tax accounting method for your business to ensure […]

Continue readingTaxes take center stage in the 2024 presidential campaign

October 21, 2024

Early voting for the 2024 election has already kicked off in some states, but voters are still seeking additional information on the candidates’ platforms, including their tax proposals. The details can be hard to come by — and additional proposals continue to emerge from the candidates. Here’s a breakdown of some of the most notable […]

Continue readingFederal court rejects FTC’s noncompete agreement ban

October 14, 2024

In April 2024, the Federal Trade Commission (FTC) approved a final rule prohibiting most noncompete agreements with employees. The ban was scheduled to take effect on September 4, 2024, but ran into multiple court challenges. Now the court in one of those cases has knocked down the rule, leaving its future uncertain. The FTC ban The FTC’s […]

Continue readingEase the financial pain of natural disasters with tax relief

October 11, 2024

Hurricane Milton has caused catastrophic damage to many parts of Florida. Less than two weeks earlier, Hurricane Helene victimized millions of people in multiple states across the southeastern portion of the country. The two devastating storms are among the many weather-related disasters this year. Indeed, natural disasters have led to significant losses for many taxpayers, […]

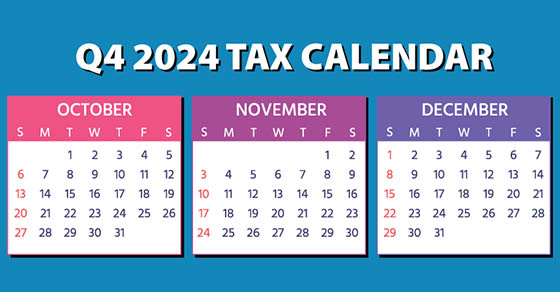

Continue reading2024 Q4 tax calendar: Key deadlines for businesses and other employers

October 7, 2024

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: […]

Continue reading