Inflation Reduction Act expands valuable R&D payroll tax credit

November 17, 2022

When President Biden signed the Inflation Reduction Act (IRA) into law in August, most of the headlines covered the law’s climate change and health care provisions. But the law also enhances an often overlooked federal tax break for qualifying small businesses. The IRA more than doubles the amount a qualified business can potentially claim as […]

Continue readingClean Vehicle Credit comes with caveats

November 8, 2022

The Inflation Reduction Act (IRA) includes a wide range of tax incentives aimed at combating the dire effects of climate change. One of the provisions receiving considerable attention from consumers is the expansion of the Qualified Plug-in Electric Drive Motor Vehicle Credit (IRC Section 30D), now known as the Clean Vehicle Credit. While the expanded credit seems […]

Continue readingIRS offers penalty relief for 2019, 2020 tax years

October 6, 2022

While the recently announced student loan debt relief has captured numerous headlines, it’s estimated that another federal relief program announced on the same day will provide more than $1.2 billion in tax refunds or credits. Specifically, IRS Notice 2022-36 extends penalty relief to both individuals and businesses who missed the filing deadlines for certain 2019 and/or 2020 […]

Continue readingThree tax breaks for small businesses

August 29, 2022

Sometimes, bigger isn’t better: Your small- or medium-sized business may be eligible for some tax breaks that aren’t available to larger businesses. Here are some examples. 1. QBI deduction For 2018 through 2025, the qualified business income (QBI) deduction is available to eligible individuals, trusts and estates. But it’s not available to C corporations or […]

Continue readingThe Inflation Reduction Act includes wide-ranging tax provisions

August 19, 2022

The U.S. Senate and House of Representatives have passed the Inflation Reduction Act (IRA). President Biden is expected to sign the bill into law shortly. The IRA includes significant provisions related to climate change, health care, and, of course, taxes. The IRA also addresses the federal budget deficit. According to the Congressional Budget Office (CBO), […]

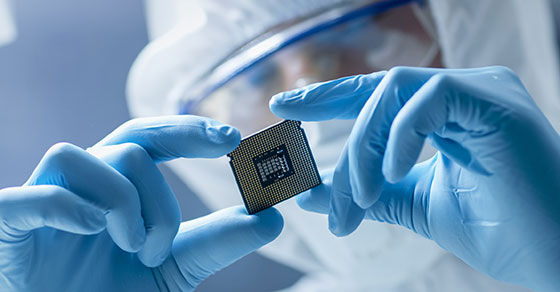

Continue readingCHIPS Act poised to boost U.S. businesses

August 15, 2022

The Creating Helpful Incentives to Produce Semiconductors for America Act (CHIPS Act) was recently passed by Congress as part of the CHIPS and Science Act of 2022. President Biden is expected to sign it into law shortly. Among other things, the $52 billion package provides generous tax incentives to increase domestic production of semiconductors, also […]

Continue readingBusinesses: Act now to make the most out of bonus depreciation

July 25, 2022

The Tax Cuts and Jobs Act (TCJA) significantly boosted the potential value of bonus depreciation for taxpayers — but only for a limited duration. The amount of first-year depreciation available as a so-called bonus will begin to drop from 100% after 2022, and businesses should plan accordingly. Bonus depreciation in a nutshell Bonus depreciation has […]

Continue readingHow do taxes factor into an M&A transaction?

July 19, 2022

Although merger and acquisition activity has been down in 2022, according to various reports, there are still companies being bought and sold. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law. Stocks vs. assets From a tax standpoint, a transaction […]

Continue reading2022 Q3 tax calendar: Key deadlines for businesses and other employers

July 15, 2022

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. August […]

Continue reading